Her Finances Part 1: Taking charge of your finances

OK, I know that finances are not something you talk about often and with any joy. However, finances are too important to not be discussed or ignored. I encourage you to start talking about your finances and start being in charge.

In this post, I will focus on key aspects that help you take charge of your finances: changing your relationship with money, having clarity on your financial status and managing your finances with the help of a budget.

I'm speaking from my own experience and hope to support your journey to financial success. As a university student struggling to make ends meet, I decided to take charge and manage my finances to ensure I was fully aware of my financial status. It wasn't an easy journey, but it was totally worth it.

What is your relationship with money?

Many women I speak to have an interesting relationship with money – and by “interesting relationship” I really mean no relationship. I typically hear the following when finances are a topic of discussion "I don't talk about money," "my husband oversees the money," " I don't know my financial status", "I don't have enough money to budget", etc. The overall attitude towards finances is typically passive and fearful. We need to change our attitude towards money – be positive and active. In the steps outlined below, we are working under the strong assumption that you are living within your means.

How can you take charge of your finances?

Step 1: Change your perspective on financial matters.

You need to see your finances as an area in your life that you control and not one that controls you. Changing your perspective is a journey, it takes continuous effort and time. I am living proof that it is attainable. I see finances as something I am comfortable with. I believe that finances are good and I’m in control

Step 2: Take stock of your financial status

Firstly, for this exercise to be beneficial, be fully honest with yourself. List out all your expenditures in a month and your monthly income from all sources. Caution: the result of this exercise might be scary. At the end of this exercise, there should be no unknowns where your finances are concerned. The first time I did this exercise, I saw where I was lacking financially and gained insight on where my money was going each month

Step 3: Create a budget

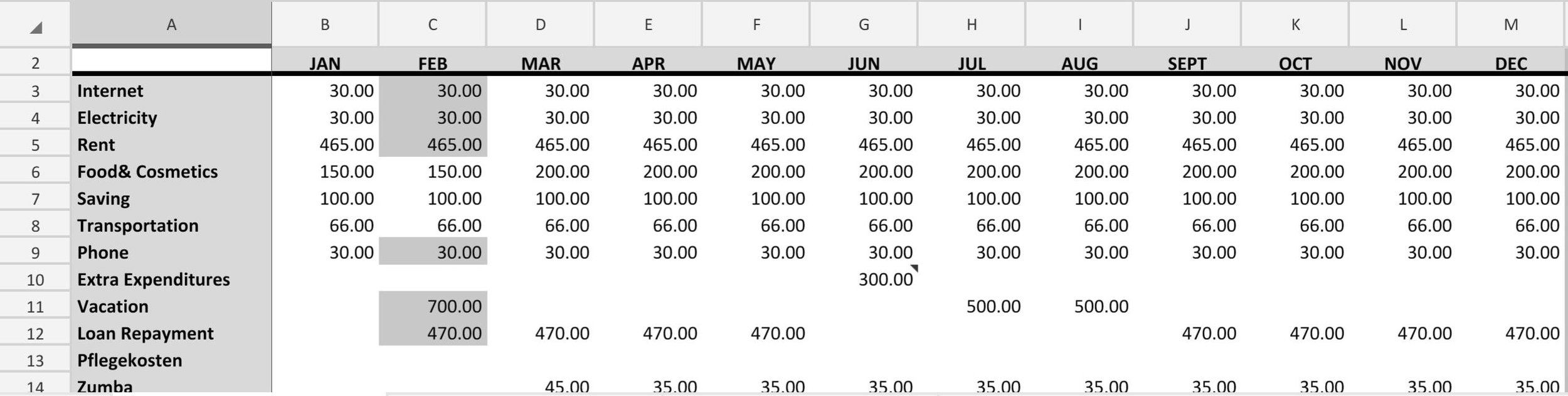

I often ask my friends and family if they have monthly budgets. Their responses are very shocking – about 95% of them didn't have budgets. If you don't have a budget, create one now. It is very simple. Create a tabular version of your income and expenditures you discovered in Step 2. See the simple examples in the Tools section below.

Bonus tip: Add savings as a line item in your budget. This is the foundation for growing your savings – the key to building financial freedom.

Step 4: Review your financial status regularly

On a regular basis you want to ask yourself: How am I doing financially? I encourage you to review your budget at least once every month. I review my finances twice monthly following my salary schedule. In your monthly review, you should do the following: add any surprise costs you didn't budget for, add missing reoccurring expenditures, add additional income and celebrate your progress

In a series of blog posts titled Her Finances, I will be sharing personal finance tips and experiences geared toward women, a subject I am passionate about. In the next post of the Her Finances blog series, we will discuss the power of saving and how to start saving money.

Final thoughts:

• Adopt a healthy attitude towards money: Use it mindfully and think about the long-term

• Actively manage your finances: You need to be in control

• Guard your finances vigilantly against external forces: Don’t let other’s control your finances

• Take stock at the end of every month: Know your financial status monthly

• Adapt to life-changing situations: There will be changes that affect your finance. Adapt your plans accordingly

Tools: Monthly and Yearly Budget

Detailed Budget for a year

Detailed Budget monthly view