|

Talking about finances is one of the topics I am learning to be more comfortable doing. Our finances play a major role in enabling us to live the amazing lives we want. Yet, many of us shy away from talking about our accomplishments and challenges regarding money.

In this post, we will explore the ten things we should all know about our money to thrive financially. Check out my other "Her Finances" posts for more financial tips and resources. #1: Do you have a good relationship with money? Our background and experiences influence our relationship with money in life. Until a few years ago, I never thought that we all have a relationship with money that goes back to our childhood. I took time to reflect on my first lessons about money and how they influenced my view as a grown-up. I now know that fear was one of the feelings that hindered my financial growth. Learning and talking about Resources #2: Are your finances healthy? We can thing about our finances as an area of our lives that can be healthy or unhealthy. If you are living above your means, in debt, and unaware of your financial status, your finances are not whole. It is crucial to overcome your fear and know your financial status. I have learned that ignoring financial challenges makes it worse. Checking in on our finances often will help you set a great foundation to grow your finances. Resources #3: What is on your financial vision board? Dreaming about our financial future inspired us to continue working towards our goals. I was always impressed when I heard people talk about their vision boards and what they wanted to have in life. About three years ago, I built my first vision board that included my financial dreams. For someone like me who likes to have concrete plans, dreaming of the future took a lot of effort to dream of the future. I now enjoy adding things to my financial vision board. Resources #4: Do you know the areas of your finances where you need to do better? Learning from our mistakes and making better financial decisions is a part of adulting. The most crucial part is identifying where we need to make changes to improve our financial status. In my early years living in Germany, I had no funds saved in an emergency fund. One lesson I learned was that saving money needed to be something I did monthly to get the discipline I needed. My latest financial lesson has been about growing my finances by building multiple income sources. Resources #5: What good money habits and actions will help you accomplish your financial goals? Implementing the learnings that we gathered to achieve our financial goals is a necessary step for us to take. This is a good time to take stock of your good practices. I have found that good money habits such as saving, budgeting, and investing have helped me achieve financial independence. Resources #6: Are you learning about how to grow your finances? The first step to achieving financial independence is to set a solid foundation by knowing your status, paying debt, living within your means, and saving. The next step is to explore how you can grow your finances and develop wealth. The strategy that I started learning about a few years ago was investing. I am honestly still learning about how to grow my wealth. Resources #7: Do you plan your expenses and income? Knowing how much you bring in and where your money goes monthly is crucial to building a solid financial foundation. I hear from people that budgeting seems complex and that they don't have one. I recommend starting simple by writing down your income and subtracting your expenses from it. You can then subtract what you would need to pay monthly to get out of debt and also how much you want to save. Once you have done that, you will have a solid budget that you can work from. Resources #8: How are you investing in yourself Over the years, I have learned that I need to be comfortable investing in myself. Part of my money journey has been giving myself the freedom to spend money on myself. As someone who why hyper-focused on saving my money, I needed to identify what I wanted to spend my money on and do it. Resources #9: How are you going to learn about finances? There are so many great experts out there who know a lot about finances. I take every opportunity I get to soak in financial knowledge from people skilled at growing their money. It's great that we have access to books, podcasts, or even the opportunity to work directly with a financial advisor. Resources #10: What are your financial goals? We need to have financial goals to continue to have healthy finances and grow. I set new financial plans at the start of every year. It helps me focus on continuing to be financially independent and build wealth. I look forward to learning a lot as I accomplish my goals. Resources Final Thoughts Writing blog posts about finances reminds me of how far I have come and how much more there is still to be done on this journey. I want everyone around me to thrive financially and get comfortable talking about money. Let's all build wealth together.

0 Comments

Talking about finances has become something I really enjoy doing. It used to be an extremely uncomfortable topic for me. However, I realized that we can only do better when we start having honest conversations about money. In our quest to accomplish financial independence, there are a lot of great things that we can do.

In this blog post, we will explore the five lessons I have learned about money over the past years. #1: Have a healthy relationship with money It took me a while to realize that I did not have a healthy relationship with money. Thinking about my finances caused me a lot of fear and anxiety. I used to say that my greatest fear was being broke. These feelings dictated how I treated money in my life. I was overly conservative with spending my money and was hesitant to make bold money moves like investing my money. Strategies to consider

Resource #2: Save your money Growing my savings was one of the first lessons I learned on my path to financial independence. I knew that I had to be disciplined about saving my money to get out of my constant lack. I started with saving a small amount and increased over time. Being able to achieve my saving goals has helped me become financially independent. Strategies to consider

Resource #3: Spend money on the right things For the longest time, I held onto my money and did not want to spend it. Over the last few years, I have learned that I need to spend my money on things that make me comfortable, help me grow and live a great life. It took me a while to learn this valuable lesson. Strategies to consider

Resources

#4: Learn about finances and grow your knowledge There is a lot we can all learn about finances. I had to seek out information about finances as I started making my decisions when I moved to Germany. Talking about money was not an open topic when I was growing up. Many people that I speak to also share similar experiences as well. I have prioritized educating myself and learning about financial strategies that are new to me. Strategies to consider

Resource #5: Know your status and set financial goals At any given time, it is particularly important to know what your financial status is. Knowing your income, debt, expenses, and other aspects of your finances is the minimum. It might feel scary to take stock of your status. However, having clarity will help give you some peace. Once you know where you stand today, it will be easier to plan for the future. As part of your goal-setting process, ensure you have your financial goals as well. Strategies to consider

Resource Final Thoughts To accomplish financial independence and growth, we need to be very intentional. The great news is that we have the power to achieve our financial goals. Time for Reflection

Achieving financial independence is one of the goals that we all need to be continuously working towards. Most of us think more about what we do not want to spend money on and less about what we should be spending our money on. It is crucial to spend money on things that improve you and your life.

In this blog post, we will explore five things that we can spend our money on that will generate great returns. Check out more "Her Finances" blog posts for practical tips to help you achieve your financial goals. #1: Learning and developing skills Investing in your personal growth is one of the best things you can spend your money on. If there are new skills that you want to acquire, now is a great time to start. Every year, I set learning goals to ensure that I am growing my knowledge. Investing in myself reassures me that I am doing something good for myself and building a great future. Knowledge is absolutely something that has huge returns. Questions to consider

#2: Things that simplifies your life We all have areas of our lives where we feel like we would be more effective if we had some help. This is one area that I have decided to spend more money on. I realized that my time is too precious to be spending doing or worrying about some tasks. I had to learn the hard way, trying to do everything on my own while working full time and taking care of a baby. I am grateful to be in a place in my life where I can get help and delegate some tasks. Questions to consider

#3: Opportunities to build wealth for the future The concept of investing your money wisely and increasing your returns is a great thing. Find what you want to invest in and how much works for you. This is also an area where I have been learning a lot and taking small steps. You can start small and continue to increase your investments over time. The great news is that there are many great resources that can help you. Questions to consider

#4: Starting a business or side hustle If you have a great business idea, invest in it and enjoy the rewards. The benefits include satisfaction from living out your dreams and also financial gain when your business is profitable. We all want to look back on our lives and be proud that we invested in our dreams. My life really changed when I built my business and started working on my passion projects. Questions to consider

#5: Having fun and building memories For the longest time, I felt that spending money on experiences like vacations or other fun activities was wasting it. Especially over the last year, I have realized that the memories we create are priceless. Having fun is a great way to recharge and enjoy yourself. Questions to consider

Final Thoughts You are a great asset, and you deserve to be invested in. Investing in your development is a way of showing yourself how much you value yourself. Time for Reflection Are you investing in yourself today? What area of your self-development do you want to invest in? What steps are you going to take first towards investing in your growth? Working towards financial independence and stability is a priority for me. I strongly believe that to live and thrive in our lives, we need to be in control of our finances. I acknowledge that finances are a very personal topic, as everyone's experiences and status vary. It is crucial that you are taking steps towards being financially healthy no matter what your current financial situation is.

In this blog post, I will share the five things I am doing differently with my money this year. Check out my other "Her Finances" posts for amazing financial tips. Starting Point: Reflecting on my financial journey I have had a sometimes good and bad relationship with money all my life. Growing up, we faced some financial challenges. A lot of my memories were centered around things that we lacked. Interestingly, my sister and I had a happy childhood, but there was always an underlying concern for how we will get things we needed. Living through those experiences made me resolute about having more positive experiences with my finances. Fast forward to 2001 when I moved to Germany. I was still struggling financially. As a student, I had to work multiple jobs at a library, café, babysitting, and other small jobs to survive. As you can imagine, that is not the quickest path to accumulating wealth. However, in those difficult times, I learned the most valuable lesson about financial health. The lesson that I learned was that I had to start taking small actions to achieve financial wellbeing. I started building my savings with small amounts that I could afford and have continued this practice until today. Over the past 20 years, I have added more tools to my toolkit that have helped me grow my finances. I am still learning and unlearning so many lessons about money. What am I doing differently this year? As I set my financial goals in 2021, I asked myself what financial decisions have helped me accomplish my goals so far and what new things I was willing to explore. Some of the things that I will be doing differently include the following: #1: Enjoying my money a little and paying for services that simplify my life Especially when you have been poor at some point in your life, it can be hard to enjoy your money. This year, I want to permit myself to do things for myself. In this phase of my life, as I am working a full-time job with a baby, this point is even more important. There are some "luxuries" that I would like to spend money on to save my time and improve the quality of my life. #2: Creating forums to share and learning bold things people are doing financially There is a lot of power in sharing your knowledge and learning from others. I want to normalize conversations about money with other amazing women in my community. I am incredibly interested in learning how others who have built sustainable wealth, explored new avenues to grow their finances, overcome generational financial challenges, and how they are continuously working towards financial independence. I also want to offer myself as an accountability partner to anyone who wants to accomplish big things financially. #3: Getting professional financial help One of the things that I have been planning to do is talking to professionals about some steps that I can take to build wealth. I have a lot to learn about investing, optimizing my taxes, planning for my son, and putting long-term plans in place for retirement. Learning from financial experts will help me make the bold moves that I plan to with my money in 2021. #4: Restarting my investing With everything that happened in 2020, I stopped investing. This decision was counterintuitive as it was a good time to invest. I was so scared of being financially unstable that I wanted to hold on to my money. This year, I want to start investing again, explore new avenues such as buying property and building long-term wealth. Although I know that Investing is the right thing for me to be doing at this stage of my financial journey, I am overly cautious. #5: Facing my fears around finances Interestingly, one of my biggest fears is being broke. It is one thought that guides a lot of the decisions that I make around money. While I want to stay financially responsible, I do not want to be driven by fear. I want to be free to do new things with my money and not be constantly concerned about being financially unstable. Final Thoughts There is so much we can learn and explore when it comes to our finances. To start your own journey to financial independence, evaluate what you are doing now, identify what you want to be doing differently, and start doing those things. Call to Action

Our personal finances are a very crucial part of our lives. On our journeys, we make a lot of financial decisions that can affect our lives in a positive or negative way. I strongly believe that we have the power to take charge of our finances and have positive experiences with money.

In this blog post, we will explore different tools that can help us build strong financial foundations. Check out previous Her Toolkit posts to help you build your personal and professional development toolkit. What does Financial wellbeing mean?

What has been my experience with Financial health and wellbeing? My experience with money has been filled with many tests and lessons learned. A lot of the lessons that I had to learn about finances, I did on my own. Growing up. conversations about money and building wealth, were not a normal occurrence. As I have progressed on my journey, making smart decisions has helped me gain financial independence and live the life I want. One of the greatest lessons that I have learned is that we need to continue learning about ways to achieve and maintain our financial health. The ways I continue my financial education is by talking to other people, reading articles and trying new techniques for growing my money. What tools can we use? Sharing some of my previous blog posts where I shared very useful tools that helped me

Great Resources Check out my videos on How to take charge of your Finances and My Story |Taking Charge of my Finances for practical tips on achieving financial independence. Call to Action What are you going to do this month to take charge of your finances? Commit to taking action. Achieving and maintaining financial health is one of my ongoing goals. On my journey so far, I have learned many valuable lessons. One of them has been to normalize the conversation around money.

In this post, I will reflect on my financial journey, the top lessons I learned about finances in 2019, and an outlook on my financial plan for 2020. MC's Financial Journey in 2019 When I think about my decisions and actions when it came to my finances in 2019, there were a lot of new and unexpected things for me. At regular intervals this year, I have been closely monitoring how I spent my money. It is important to me to always know my financial status, plan for how I want to spend my money, and track how I spend it. Especially since I took some financial risks this year, I needed to stay focused on my financial health. What lessons did I learn about money? #1: Taking big financial steps is very scary This year, I made a huge investment that impacted my finances significantly. The surprising part was that I was not prepared for the feelings I will have after I made the investment. I thought I was ready, and all I needed to do was work hard to replenish my savings after I took a lot of money out to invest in a project. Interestingly, I did not plan for the emotional impact it would have on me. Being worried about Read more about "My experience making difficult Financial Decisions". #2: Be ready to pay for things that make your life easier This one was hard for me to learn. I had to fight the mental battle of feeling like I can do everything myself. Learning to delegate tasks or part of my life to make some time available for things that I really want to do. This year I spent money on household support and ordered things online to save me some time. Although it took me a while to overcome the guilt I was feeling, when I started seeing the great results of paying a little more to make my life easy, I knew it was worth it. #3: Continue practicing your good money habits In my post titled "10 things to do for your financial wellness in 2019", I shared some of the things I was committed to doing in my finances this year. Especially with everything going on this year, I was reminded of the fact that the reason I was successful financially was that I am disciplined and have learned good money habits. Knowing that I could rebuild my savings because I had been practicing for a while, gave me confidence. #4: Talk about your finances with people Two conversations about money really helped me this year. First of all, I spoke to a lady like me who wanted some advice on building her finances. Being able to share some of the tips that have helped me on my journey reminded me of my humble beginnings and how I got here. The second conversation that helped me was talking to another woman who is in a similar phase in her life and has comparable financial responsibilities. Talking to someone who could relate to my situation was very refreshing. I know talking about money is not something we do very often. There are a lot of benefits from talking to people around you and sharing financial knowledge. #5: Be bold when exploring new financial aspects I started investing money seriously in 2017. Through 2018 I stayed consistent and continued my learning journey. However, in 2019, with the markets being less predictable, I found myself being afraid to make any investment moves. I stopped learning about investments and didn't do anything for most of the year. As I reflect on my behavior, I see that navigating uncertainty with finances is something I am not comfortable with and need to learn. Outlook on My Financial Plan for 2020 As I set my goals for 2020, I have been thinking about what I want to do with my finances in 2020. Here are some of my initial ideas that I will be adding to my list

Final Thoughts

Call to Action

Great Resources Lately, I have been reflecting on my financial journey, some of the tough decisions I had to make and the lessons I learned on the way. There have been so many times where my finances were a significant factor in my personal growth and development. When I think about my relationship with money, it used to be one of worry and now it has developed into one of respect.

In this blog post, I will share the five hardest financial decisions I have made and how they have positively influenced my financial status. My 5 difficult Financial Decisions Becoming Financially Independent There is a significant level of comfort that we all had when we are growing up and living under our parents’ roofs. For me, it came to an end at the age of 16. At that time, I started living on my own and taking care of myself financially. My journey started quite rough as I didn't have a solid financial foundation and had to build it all up from scratch. Looking back, I now see that this was the start of many more financial decisions to come. Lessons I learned

Reducing the number of hours I worked to focus on school While I studied for my Bachelor's degree, I was working on many small jobs simultaneously. I worked in a café, on campus, and babysat to raise funds I needed for my basic needs. As my expenses increased, I found myself having to work more, which in turn took away time that I needed to study. I decided to cut my living expenses and focus on school. The financial discipline I learned in this phase of my life is a continuous companion. Lessons I learned

Paying for my graduate degree I had just started working full time and really wanted to earn my Master's degree. Although education in Germany was mostly free or low-cost, I chose a school and course that will let me study part-time and gain a degree in English, which meant I had to pay tuition. I must say I feel very fortunate that the cost was nothing close to studying in other countries. However, since I had to fund my tuition fully, I had to save a lot of the money I made in my first full-time job. I remember struggling to pay the first 2000 euros for my first classes. This was one of my most significant investment in myself and my career, and it has paid off. Lessons I learned

Investing in my first long-term stocks In the past years, I focused on growing my savings. The discipline I learned in my early days helped me build a significant emergency fund and savings. However, I started learning a new lesson about other ways to grow my money. When I started my investment journey, I took baby steps. I started with a very small investment and grew it as I got more confident. Lessons I learned

Taking money out of my long-term savings to invest in a big project This is the most recent, most significant, and hardest decision I have ever made with regards to my finances. For many years, I have been very disciplined about growing my savings. I have not missed a monthly payment to my saving account for at least the last ten years. So, when the time came for me to literally move a lot of my savings into an investment, I started to panic because I did not feel as financially secure as I like to be. Now that I'm thinking about it, I was in no financial danger. This investment has been a dream for a long time, and now it's a reality. Lessons learned

Call to Action

Final Thoughts

Great Resources Creating vision boards is a topic that is widely discussed at the beginning of a year. Personally, I have not created a vision board with pictures before. The main reason is that I am more of a structured person and the "arts and craft" nature of vision boards is less organized than I like things to be. However, a few months ago when I started thinking about some financial goals that I want to achieve over the next years, I felt a vision board would be a great way to visualize them.

In this blog post, I will share the benefits of visualizing your goals and some of the questions I asked myself while I created my financial vision board. This post continues the Her Finances series where I write about being financially independent, financial planning, adopting healthy financial habits and taking charge of your finances. What are the benefits of creating a financial vision board?

Create your own Financial vision board Let me start by saying that it is important to choose the type of visualization that works best for you. Personally, I find text the best way to visualize my goals. Here are five questions to ask yourself while you create your vision board: #1: What are some big financial goals you want to achieve? The main task here is creating an overview of the different areas of your finances that you want to work towards. Some of the things that come to mind are: create an emergency fund, grow savings, be debt free, create additional sources of income, invest in property, save for your children or grow long term investments. #2: What is the timeline you want to work towards? Typically a vision board is created for a year. However, being that some of your big financial goals take more than a year to achieve, it is essential to outline a realistic timeline. The objective is to commit to a date by which you want to achieve your goals. Each goal can have a different due date. I encourage you not to overthink the timeline, write what you think and adjust as you know more. #3: What are some of the things you want to start doing or do differently? Now that you know what you are working on determine which new financial habits you want to adapt to achieve your goals. For some inspiration, check out my previous blog post Good Money habits for 2019. I like the saying "Don't keep doing the same thing and expecting different results." #4: What kind of support do you need? Especially if you are working on big goals, it is essential to look for external support. This serves the purpose of providing the financial knowledge that you don't have as well as gaining support through the process. Your support can be in the form of a financial experts, trusted friends, trainings, books or podcasts. #5: How are you going to track your progress? Think about the small steps you will take and how you will measure the progress you are making towards achieving your goals. It is important to celebrate your accomplishments, and the only way you'll know what you have achieved is if you continuously track your progress. Final Thoughts

Call to Action What financial goals do you want to work on? Define your goals When do you want to achieve them? Determine your timeline Great Resources Most of us set financial goals at the start of the year with the best intent. The great news is that there are strategies we can start applying today that will make us successful. To achieve our financial goals, we will need to learn some new money habits and continue the good ones we already have.

Recently, I started thinking of ways to achieve all-round health in my finances. These two concepts spoke to me: Financial wellness which is the process of learning how to successfully manage financial expenses and Financial Well-being which is having financial security and financial freedom of choice, in the present and the future. In this blog post, we will explore ten techniques you can apply to achieve financial freedom and health. #1: Know your financial status Having clarity on your overall financial status will allow you to identify actions that you need to take. Write down your income, expenses, debts, financial commitments, and savings. Transparency in your finances will bring more calmness than when you hide from your status. #2: Create a financial plan Setting concrete financial goals and planning action may sound foreign to you. However, as with anything we want to be successful in, we need to set goals that we can work towards and track our progress. Explore Six steps to build your Financial Plan from my previous post. #3: Make extra money Having additional sources of income helps us become financially independent. I grew up around women who always had a side hustle and learned from them. Exploring side hustles provides you with opportunities to make some extra money and simultaneously chase your passions. Start small and grow your additional income consistently. #4: Understand your taxes It's currently tax season in this part of the world. Our relationship with taxes is mostly one of confusion and ignoring its existence. Making sure you are paying the right taxes and legally saving taxes will improve the way you view taxes. Taxes are a constant part of our lives and one we can master if we put some time into learning about it. #5: Save your money Reframing the way you think about savings will help it become a normal part of your life. What you do by saving is, putting money aside regularly to achieve your bigger financial goals. Learn some practical tips from my previous blog post - How to grow your Savings. #6: Invest in long-term options Once you start saving consistently, it's time to explore ways to grow your money. Investing in a house, stock market or other business ventures are a few ways to start making your money work for you. Available resources can help you make the right investment choice for you. Start investing as soon as you can. Sometimes I wish I started investing earlier. I began investing in 2017 and have been learning valuable lessons ever since. #7: Get financial advice We typically find it easy to go to a doctor when we have a health issue. Think about it this way, seeking financial advice from trusted sources is a way to make sure you are financially healthy. Ask questions and act on the great advice you get. #8: Talk about money Especially if your upbringing was like mine, talking about money was not normal. One of the biggest lessons I've learned is the power of talking about money with your partner, family and co-workers as openly as possible. #9: Learn about finances Being financially literate is an essential foundation for success. Read great books, listen to financial podcasts, attend trainings and use free resources. Gather all the knowledge you can on the financial areas you want to get better at. #10: Celebrate your financial successes While you are working towards achieving your financial goals, remember to celebrate your wins. Small, medium and big accomplishments deserve to be honored. The positive vibes you feel will motivate you for the future. Call to Action What are you committed to doing differently to achieve financial wellness this year? Final Thoughts

Great Resources As you start thinking about your goals for 2019, I would like to recommend adding "cultivating good money habits" to your list. On our continuous quest to become financially independent and grow our wealth, we need to learn and practice money habits that support our mission.

This blog post continues the Her Finances series. Explore ten simple good money habits and how you can start making them yours today. While you read, select a few habits and write down how you plan to make them happen in 2019. #1: Live within your means This is an essential financial habit that you need. If you pick only one from the list, let it be this one. Your journey to financial independence starts with respect for your money and making wise money decisions. How:

#2: Know your financial status Knowledge is power when it comes to your financial situation. It is essential to know where you stand financially. Sometimes it seems more comfortable not to know. However, if you want to see the positive change, you need to get comfortable with knowing your real financial status. How:

#3: Talk about money Being open about your financial status and challenges is very crucial to take charge of your finances. We have been trained to treat finances like a taboo topic, and this is hindering our financial growth and freedom. Sharing money experiences and learnings with your trusted friends and family unlocks many benefits. How:

#4: Have a financial plan Until a few years ago, I never really understood what a financial plan was. Having a plan for what I wanted to do with my money and how my money will work for me was a very foreign concept. Writing down the things you want to be able to do like get out of debt, buy a house, retire comfortably, save or pay for education provides you with a clear view of what you are working towards financially. How:

#5: Find ways to save money As part of your monthly budget reviews look for areas where you could potentially be saving a little more money. I am living proof that saving money can be more fun than spending money. Watching your savings grow can be very rewarding. How:

#6: Get expert help You don't have to go through your financial challenges and growth alone. There are professionals out there who can provide guidance and share knowledge on how you can achieve your financial goals more efficiently. How:

#7: Grow your money Looking for ways to increase your current income, create new income streams or invest your money should also be on your list. Building wealth is one area we need to explore more on our financial journey. How:

#8: Be financially literate Yes, we need to be financially literate. There are so many things to learn about finances. Be on a mission to learn about different aspects of money. Somehow we are willing to bridge our knowledge gaps on almost every other topic, but we neglect our financial literacy. How:

#9: Surround yourself with "good money" people Being in an environment of people who save and are responsible with their money is a great way to stay on track. Surrounding yourself with this group of people will offer you great learning opportunities and experiences that help you achieve your money goals. How:

#10: Invest in yourself Prioritize investing in opportunities that will help you get to the next level on your journey. Your personal growth is the best investment opportunity that will bring you the most return. We need to invest more in ourselves to get the results we want. How:

Final Thoughts

Great Resources

“Enrich your financial portfolio with your savings” - MC Moving on to the next chapter of the Her Finances series – How to grow your Savings.

On my journey to Financial Independence, I learned the benefits of being disciplined in my savings. You might ask, have you always been successful? My honest response is, I have been 90% successful. The exceptions have been when I was going through transitions and had no income. With this blog post, I want to encourage you in every phase of your saving journey. It's an achievement to get started and an even more significant achievement to power through the learning phases. Benefits of growing your Savings To motivate you more, here are some compelling reasons why we should grow our savings:

My saving journey - First memory & learning to save My earliest memory of saving was when my mum opened Savings accounts for my sister and me at the age of three. I was so proud to save my money. Sadly life happened, and I wasn't able to continue my saving journey until I started my business at age 13 and started saving my profits. The seed of saving was planted and would later grow in high school. My friends and I replicated something we watched our mothers do. It was a saving system where we pulled money together to get larger sums. Each month, we pulled our money together, and one of us will take the bulk sum. We rotated until everyone got her chance to get the big sum. Continuing my saving journey, when I moved to Germany, I opened a fixed savings account where I saved fifty euros monthly. I remember having to squeeze fifty Euros. I had small beginnings to the saving discipline I have today. Today i am able to save about 25% of my income monthly. My Top 5 Saving Tips The five best practices below have helped me grow my savings over the past fifteen years. Make your savings a priority Your attitude towards saving should be to pay yourself first. Take out your savings before you start spending your money. If your savings are the last thing you take out monthly, it will never happen. Take the first step Start with whatever amount you can afford today. It is crucial to see your savings as a journey. It is not one and done; it is continuous. Increase your Savings when your income increases. Every time I get a salary raise, I increase my savings. I see more income as an opportunity to be more financially secure not spend more. Be consistent Make monthly payments to your savings account. I have had excellent results with transferring a fixed amount into my savings account on the same day of every month. The routine helps saving become second nature. Always save, no matter what. It is very easy to stop saving when things get tough. Set rules for when it is OK to change course or take money out. I only take money out of my savings to invest in learning, pay for periodic bigger bills and the things I saved for. Set savings goals and work towards them Plan your savings and define the goals you want to meet. Remember to set a timeline to achieve your goals. It's gratifying to reach your saving goals. When we set goals and track our progress, we increase our success rate. Suddenly something that feels like a punishment serves a purpose and becomes a little more exciting. Learn, adjust and pivot It's a journey, be ready to learn and make changes. Get to know what works best for you. Don't be discouraged when things don't go as planned. Keep learning, try new techniques and get the support you need. There are many useful resources to help you grow your savings, see some listed below. Final Thoughts

Great Resources

Continuing the Her Finances series, let's get personal and talk about your relationship with money. Do you feel stressed when you think about your finances? You are not alone. Concerns about bills and expenses emerge as a top source of stress among most groups of women (Source: National Survey). It is crucial to develop a healthy and positive relationship with money to attract more of it.

In this blog post, I will share some insights on creating a healthy relationship with your money. Starting with my relationship with money and then five ways you can develop a healthy relationship with money. What is your relationship with money? What are the first three words that come to your mind when you think about money? Write them down. The three words I think about with regards to money are Opportunity, Multiplying, and Gratitude.

What type of relationship should we have with money? At a financial workshop I attended recently, women shared the words they associated with money. Most of the words shared were slightly negative. It proved the case that most women have a negative relationship with money. To create, grow, and keep wealth, you need to have a healthy relationship with it and an action plan (Source: Is Your Relationship with Money Healthy?). I am on a mission to help women like me have a more positive relationship with money. Remember the three words you associate with money; we want them to be positive. My relationship with money Let me begin by sharing my relationship with money using some reflective points: My earliest memories In Nigeria, it was customary to give money as gifts to children during holidays and birthday celebrations. I remember when family members gave me money, I thought I could buy everything I needed. I enjoyed looking at my money and planning what I could buy with the money I got. Making my own money To grow my "pocket money" at age thirteen, I started my first small business where I sold a homemade Nigerian beverage - Zobo. I learned the art of growing your money from the women in my life. Being resourceful and creating financial opportunities was promoted in my extended family. Learning do's and don'ts I learned a lot of lessons about money by observing people around me. It has always been important to me not to repeat the mistakes I saw. I wanted to be financially independent, have enough and be able to share my money. Though the financial behaviors I observed growing up informed my money journey, I am redefining my relationship with money. From not having enough to sufficient Growing up, we did not have free access to everything we needed. My relationship with money progressed from the fear of not having enough to being comfortable in having what I needed. Overcoming my fear of being broke has been an essential step for me on my money journey. I know now that fear of being broke and being responsible with money are not the same thing. Learning to be financially responsible After I became financially independent, I quickly learned that the decisions I make with regards to my money have significant consequences. Especially as more money became available to me, I had to keep reminding myself of my small beginnings and the fact that I needed to be responsible. My decision to grow my savings instead of spending too much of material things has helped me get to a place of abundance. 5 ways to develop a healthy relationship with money If you have an unhealthy relationship with money, you will never create the abundance you wish you had. (Source: Your Relationship with Money: 11 Ways To Make It Healthy). Here are some ways to develop a healthier relationship with money. Be more aware In any healthy relationship, you strive to be more aware of your actions and how they affect the other party in the relationship. It should be the same with your money. Start by unpacking how you feel about money, then list your strengths with money as well as your weaknesses with money. From today, pay attention to what you are doing with your money and how you are treating your money. Have money goals When we have goals we are working towards, we tend to spend time and focus to achieve them. It is essential to have money goals that you are working towards always. Talk about money The more we talk about money, the more we comfortable we get with it. People around you have valuable money do's and don’ts that they can share with you. Talking about money empowers you. Learn from your money mistakes I am a firm believer that there are lessons to be learned from the mistakes we make. Actively work to get out of the bad place you might be now because of debt or harmful spending habits. The success you achieve will fuel your future positive relationship with money. Be financially literate To develop a healthy relationship with money, spend time educating yourself. Learn about ways to create, grow and maintain your wealth. There are many interesting resources out there that can help you on your journey. Read books, take classes, talk to professionals, do everything you can to learn more about your money. Final Thoughts

Great Resources

Do you have a financial plan? Recently at an event I attended, I heard a scary statistic - "20% percent of women are comfortable with their financial knowledge. The number is low because they lack planning or fail to take action" (Source: 2015 Insurance Barometer Study). The good news is "Women are eager for information about financial planning and investing - 92% of women want to learn more about financial planning" (Source: Money fit women study).

Continuing the "Her Finances" series, let’s discuss a tool that will help us take control of our finances and achieve our financial goals- Financial planning. In this post, I will focus on what a financial plan is, how to create your financial plan, the continuous process of financial planning and share some resources for additional research. Starting point I encourage you to say the following about your financial journey:

What is Financial Planning? There are many definitions of financial planning. Here are some that I liked:

Why do you need a financial plan? Creating and managing your financial plan has many benefits. A financial plan will help you:

My financial planning journey Until about three years ago my financial planning was focused primarily on growing my emergency fund and my savings. I set goals that I wanted to achieve and worked towards them. My commitment made me very successful in achieving my saving goals. With my move to the US in 2015, I began to re-evaluate my financial goals, get exposure to other options and widen my perspective on financial planning. I updated my financial plan and started educating myself on different ways to achieve my financial goals. A few new areas I discovered were saving for retirement and investing in stocks. I am looking forward to exploring more areas as I learn more. Six simple steps to start your financial planning Step 1: Know your current financial situation Start by being very transparent about your current financial situation. Before you begin setting your goals, you need to take stock of where you are today. Knowing your financial status will help you establish your starting point and set you up for success. Include your income, debt, current savings as well as other financial commitments. Step 2: Define your financial goals What are your financial goals? To be successful, you need to know what you are working towards. In my research on financial planning, I found the following essential categories: Savings, Debt, Emergency Fund, Investments, and Retirements.

Step 3: Create a financial plan Like with everything we want to take control of, we need a plan. A financial plan helps you achieve your financial goals more efficiently. Set target dates and milestones to achieve your goals. For example, if your goal is saving up $12,000 for a down payment on a house. You want to be clear on how much you can save monthly and how long it will take you to save up to your goal. You want to be able to have a clear answer to the question: What can I do today to achieve my financial goals? Step 4: Start implementing your plan Now that you have a plan; it is time to take the first step and start working towards your plan. Practice being disciplined and staying committed to your plan. Step 5: Track your progress At all times, you want to be able to answer the question - How close are you to achieving your financial goals? Knowing where you are will either confirm that your plan is working or highlight areas you might need to change. Regularly measure the progress you are making towards achieving your financial goals. Seeing progress will encourage you to continue your journey. Step 6: Review and adapt your plan I recommend at least a monthly review of your plan. As we go through life, changes to your financial plan will be required. You create your plan based on some assumptions if they change you want to ensure your plan matches your learning. Plans are living documents, feel free to update. Call to Action: Start creating your financial plan

Final Thoughts

Great Resources

Every woman needs to be the steward of her finances. OK, I know that finances are not something you talk about often and with any joy. However, finances are too important to not be discussed or ignored. I encourage you to start talking about your finances and start being in charge.

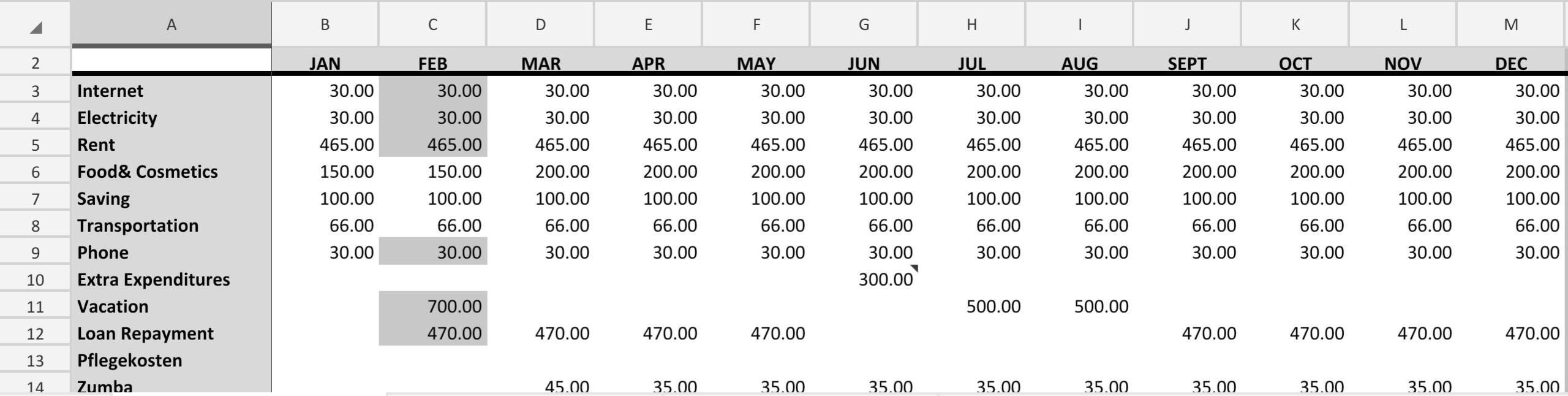

In this post, I will focus on key aspects that help you take charge of your finances: changing your relationship with money, having clarity on your financial status and managing your finances with the help of a budget. I'm speaking from my own experience and hope to support your journey to financial success. As a university student struggling to make ends meet, I decided to take charge and manage my finances to ensure I was fully aware of my financial status. It wasn't an easy journey, but it was totally worth it. What is your relationship with money? Many women I speak to have an interesting relationship with money – and by “interesting relationship” I really mean no relationship. I typically hear the following when finances are a topic of discussion "I don't talk about money," "my husband oversees the money," " I don't know my financial status", "I don't have enough money to budget", etc. The overall attitude towards finances is typically passive and fearful. We need to change our attitude towards money – be positive and active. In the steps outlined below, we are working under the strong assumption that you are living within your means. How can you take charge of your finances? Step 1: Change your perspective on financial matters. You need to see your finances as an area in your life that you control and not one that controls you. Changing your perspective is a journey, it takes continuous effort and time. I am living proof that it is attainable. I see finances as something I am comfortable with. I believe that finances are good and I’m in control Step 2: Take stock of your financial status Firstly, for this exercise to be beneficial, be fully honest with yourself. List out all your expenditures in a month and your monthly income from all sources. Caution: the result of this exercise might be scary. At the end of this exercise, there should be no unknowns where your finances are concerned. The first time I did this exercise, I saw where I was lacking financially and gained insight on where my money was going each month Step 3: Create a budget I often ask my friends and family if they have monthly budgets. Their responses are very shocking – about 95% of them didn't have budgets. If you don't have a budget, create one now. It is very simple. Create a tabular version of your income and expenditures you discovered in Step 2. See the simple examples in the Tools section below. Bonus tip: Add savings as a line item in your budget. This is the foundation for growing your savings – the key to building financial freedom. Step 4: Review your financial status regularly On a regular basis you want to ask yourself: How am I doing financially? I encourage you to review your budget at least once every month. I review my finances twice monthly following my salary schedule. In your monthly review, you should do the following: add any surprise costs you didn't budget for, add missing reoccurring expenditures, add additional income and celebrate your progress In a series of blog posts titled “Her Finances”, I will be sharing personal finance tips and experiences geared toward women, a subject I am passionate about. In the next post of the "Her Finances" blog series, we will discuss the power of saving and how to start saving money. Final thoughts: • Adopt a healthy attitude towards money: Use it mindfully and think about the long-term • Actively manage your finances: You need to be in control • Guard your finances vigilantly against external forces: Don’t let other’s control your finances • Take stock at the end of every month: Know your financial status monthly • Adapt to life-changing situations: There will be changes that affect your finance. Adapt your plans accordingly Tools: Monthly and Yearly Budget |

AuthorMarie-Christin Anthony Categories

All

Archives

November 2023

|

RSS Feed

RSS Feed